UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

QuickLinks-- Click here to rapidly navigate through this document

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No.)

Filed by the Registrantýx |

Filed by a Party other than the Registranto

|

Check the appropriate box: |

ýx | | Preliminary Proxy Statement |

o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o | | Definitive Proxy Statement |

o | | Definitive Additional Materials |

o | | Soliciting Material Pursuant to §240.14a-12

|

Dade Behring Holdings, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

N/A |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | |

Payment of Filing Fee (Check the appropriate box): |

ýx | | No fee requiredrequired. |

o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-110-11. |

| (1) | (1) | | Title of each class of securities to which transaction applies:

|

| | (2) |

| (2) | Aggregate number of securities to which transaction applies:

|

| | (3) |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | (4) |

| (4) | Proposed maximum aggregate value of transaction:

|

| | (5) |

| (5) | Total fee paid:

|

o | | |

o | Fee paid previously with preliminary materials. |

o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | (1) | | Amount Previously Paid:

|

| | (2) |

| (2) | Form, Schedule or Registration Statement No.:

|

| | (3) | | Filing Party:

|

| (3) | (4)Filing Party: |

| | |

| (4) | Date Filed:

|

| | |

| | |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

Dear Fellow Dade Behring Shareholder:

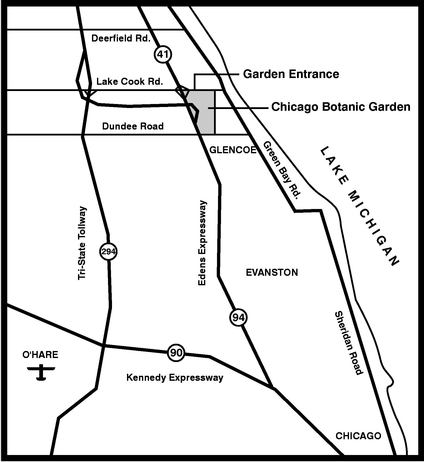

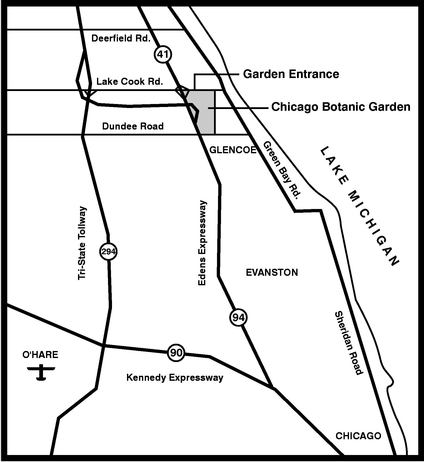

It is my pleasure to invite you to the Annual Meeting of Shareholders of Dade Behring Holdings, Inc. to be held at 2:3:00 p.m. Central Daylight Time on Wednesday,Monday, May 28, 2003, in the Education Center Auditorium23, 2005, at the Chicago Botanic Garden, 1000 Lake Cook Road, Glencoe, Illinois.

A Notice ofAt the Annual Meeting, if you are a holder of Dade Behring common stock, we will ask you to re-elect two directors and aapprove an amendment to the Company’s Fourth Amended and Restated Certificate of Incorporation that will increase the number of shares of common stock and preferred stock that the Company will be authorized to issue.

We will also review the progress of the Company during the past year and answer your questions.

This booklet includes the Notice of Annual Meeting and Proxy Statement. The Proxy Statement coveringdescribes the business ofthat we will conduct at the meeting are enclosed, along with Dade Behring'sAnnual Meeting. The Proxy Statement and the Company’s Annual Report to Shareholders for the fiscal year ended December 31, 2002.2004 provide information about the Company you should consider when you vote your shares.

It is important that your shares will be represented and voted at the Annual Meeting. If you plan to attend, please check the box provided on the proxy card. Whether or not you plan to attend the Annual Meeting in person, we urge you to complete, sign and return the enclosed proxy card in the accompanying postage-paid envelope or to vote by telephone, so that your shares will be represented and voted at the Annual Meeting.telephone.

| Sincerely, | |

|

/s/ JIM REID-ANDERSON

| |

| Jim Reid-Anderson

Chairman of the Board, President

and Chief Executive Officer | |

1717 Deerfield Road, Deerfield, IL 60015

NOTICE OF THE 20032005 ANNUAL MEETING OF SHAREHOLDERS

April 25, 20036, 2005

To our Shareholders

THE ANNUAL MEETING OF SHAREHOLDERS OF DADE BEHRING HOLDINGS, INC., a Delaware corporation (the "Company"“Company”), will be held on Wednesday,Monday, May 28, 2003,23, 2005, at 2:3:00 p.m. Central Daylight Time in the Education Center Auditorium at the Chicago Botanic Garden, 1000 Lake Cook Road, Glencoe, Illinois, for the following purposes:

1.

- To

elect threere-elect two directors to hold office for three years;

2.

- To approve a proposal to amend the

Company's ThirdCompany’s Fourth Amended and Restated Certificate of Incorporation to increase the number of authorized shares of common stock and preferred stock;

- and

3.

To approve the Dade Behring Nonemployee Directors' Deferred Stock Compensation Plan;

4.To approve the Dade Behring Employee Stock Purchase Plan; and

5.- To transact such other business as may properly come before the Annual Meeting.

Only shareholders of record at the close of business on April 1, 2003March 31, 2005 will be entitled to vote at the Annual Meeting.

A copy of the Company'sCompany’s Annual Report to Shareholders for the fiscal year ended December 31, 2002,2004 is being mailed to you with this Notice and the Proxy Statement.

| By order of the Board of Directors, |

|

/s/ LOUISE S. PEARSON

Louise S. Pearson

Vice President, General Counsel and

Corporate Secretary |

All shareholders are cordially invited to attend the Annual Meeting, but whether or not you expect to attend the Annual Meeting in person, please vote your shares by proxy, either by dating,completing, signing, and returning the enclosed proxy card in the postage-paid envelope provided, or by calling the telephone number and following the instructions provided on your proxy card.

DADE BEHRING HOLDINGS, INC.

1717 Deerfield Road, Deerfield, IL 60015

PRELIMINARY PROXY STATEMENT PRELIMINARY

FOR THE 20032005 ANNUAL MEETING OF SHAREHOLDERS

ABOUT OUR ANNUAL MEETING

Why have I received these materials?

The accompanying proxy, which is being mailed and made available electronically to shareholders on or about April 25, 2003,6, 2005, is solicited by the Board of Directors of Dade Behring Holdings, Inc. (referred to throughout this proxy statement as "Dade“Dade Behring," "the” “the Company," "we"” “we” and "us"“us”) in connection with our Annual Meeting of Shareholders that will take place on Wednesday,Monday, May 28, 200323, 2005 at 2:3:00 p.m. Central Daylight Time in the Education Center Auditorium at the Chicago Botanic Garden, 1000 Lake Cook Road, Glencoe, Illinois. You are cordially invited to attend the Annual Meeting and are requested to vote on the proposals described in this Proxy Statement.proxy statement.

Who is entitled to vote at the Annual Meeting?

Holders of common stock of Dade Behring as of the close of business on April 1, 2003March 31, 2005 will be entitled to notice of and to vote at the Annual Meeting. On April 1, 2003,March 14, 2005 there were outstanding and entitled to vote 40,039,06744,xxx,xxx shares of common stock, each of which is entitled to one vote with respect to each matter to be voted on at the Annual Meeting.

How do I vote my shares at the Annual Meeting?

If you are a "record"“record” shareholder of common stock (that is, if you hold common stock in your own name in Dade Behring'sBehring’s stock records maintained by our transfer agent, Mellon Shareholder Services), you may complete and sign the accompanying proxy card and return it to Dade Behring or deliver it in person. In addition, you may vote by using a toll-free telephone number by following the instructions included with your proxy card. The telephone voting facilities for shareholders of record will close at 11:0059 P.M. Eastern Standard Time on May 27, 2003.22, 2005.

"Street name"“Street name” shareholders of common stock (that is, shareholders who hold common stock through a broker or other nominee) who wish to vote at the Annual Meeting will need to obtain a voting instruction form from the institution that holds their shares and to follow the voting instructions on that form.

Can I change my vote after I return my proxy card or after I vote by telephone?

Yes. After you have submitted a proxy, you may change your vote at any time before the proxy is exercised by submitting a notice of revocation or by a proxy bearing a later date. Regardless of whether you voted using a traditional proxy card, or by telephone, you may use either method to change your vote. You may change your vote either by submitting a proxy card prior to the date of the Annual Meeting or by voting again prior to the time at which the telephone voting facilities close by following the procedures applicable to those methods of voting. In each event, the later submitted vote will be recorded and the earlier vote revoked. In addition, you may change your vote by casting a ballot in person at the Annual Meeting.

What constitutes a quorum for purposes of the Annual Meeting?

The presence at the Annual Meeting in person or by proxy of the holders of a majority of the voting power of all outstanding shares of common stock entitled to vote will constitute a quorum for the transaction of business. Proxies marked as abstaining (including proxies containing broker

non-votes) on

any matter to be acted upon by shareholders will be treated as present at the meeting for purposes of determining a quorum but will not be counted as votes cast on such matters.

What vote is required to approve each item?proposal?

The election of directors at the Annual Meeting requires the affirmative vote of a plurality of the votes cast at the Annual Meeting by shares represented in person or by proxy and entitled to vote for the election of directors. This means that the two nominees for director who receive the most affirmative votes will be elected.

The proposal to amend Dade Behring's ThirdBehring’s Fourth Amended and Restated Certificate of Incorporation to increase the number of our authorized common and preferred shares requires the affirmative vote of a majority of the outstanding shares entitled to vote at the Annual Meeting.

Each other item to be voted upon at the Annual Meeting requires the affirmative vote of a majority of the shares represented in person or by proxy at the Annual Meeting and entitled to vote on the matter for approval.

What effect does an abstention have?

A properly executed proxy marked "ABSTAIN"“ABSTAIN” with respect to any matter will not be voted, although it will be counted for purposes of determining whether there is a quorum. An abstention will have no effect on the outcome of the election of directors, but an abstention on any other matter will have the effect of a negative vote on that matter. If you hold your shares in "street name"“street name” through a broker or other nominee, shares represented by "broker non-votes"“broker non-votes” will be counted in determining whether there is a quorum, but will not be counted as votes cast on any matter.

What are "broker non-votes"“broker non-votes”?

If you hold shares through a broker, bank or other nominee, generally the nominee may vote the shares for you in accordance with your instructions. Stock exchange and NASD rules prohibit a broker from voting shares held in a brokerage account on some proposals (a "broker non-vote"“broker non-vote”) if the broker does not receive voting instructions from you. Under these rules, a broker may not vote in its discretion on item 2, the proposal to amend Dade Behring's Third Amended and Restated Certificate of Incorporation. Shares that are subject to a broker non-vote and in respect of which voting instructions are not received by the broker are counted for determining the quorum but are not voted on the particular matter. Failure to provide voting instructions to a broker on item 2 will result in a broker non-vote, which will have the effect of the relevant shares being voted against approval of item 2.

How does the Board recommend that I vote my shares?

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board of Directors. The Board'sBoard’s recommendation is set forth together with the description of each item in this Proxy Statement.proxy statement. In summary, the Board unanimously recommends a vote:

1.

- FOR the election of the nominated directors;

- and

2.

- FOR the amendment to increase the number of authorized shares of common stock and preferred

stock;

3.FOR the approval of the Dade Behring Nonemployee Directors' Deferred Stock Compensation Plan; and

4.FOR the approval of the Dade Behring Employee Stock Purchase Plan.

stock.2

With respect to any other matter that properly comes before the Annual Meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, in the proxy holders'holders’ own discretion in the best interests of Dade Behring. At the date this proxy statement went to press, the Board of Directors had no knowledge of any business other than that described in this proxy statement that will be presented for consideration at the Annual Meeting.

Who will bear the expense of soliciting proxies?

Dade Behring will bear the cost of soliciting proxies in the form enclosed. In addition to the solicitation by mail, proxies may be solicited personally or by telephone, facsimile or electronic transmission by our employees. We may reimburse brokers holding common stock in their names or in the names of their nominees for their expenses in sending proxy materials to the beneficial owners of our common stock.

Shareholder proposals and nominationsHow may a shareholder make a proposal or nominate a candidate for election as a director?

Any shareholder who intends to present a proposal at Dade Behring'sBehring’s annual meeting of shareholders to be held in 20042006 and who wishes to have the proposal included in Dade Behring'sBehring’s proxy statement for that meeting must deliver the proposal to Louise S. Pearson, the Corporate Secretary, by no later than December 16, 2003.7, 2005. All proposals must satisfy the rules and regulations of the Securities and Exchange Commission to be eligible for inclusion in the proxy statement.

Shareholders may present proposals that are proper subjects for consideration at an annual meeting, even if the proposal is not submitted by the deadline for inclusion in the proxy statement. To do so, the shareholder must comply with the procedures specified in Dade Behring'sBehring’s bylaws. The bylaws require all shareholders who intend to make proposals at an annual meeting to submit their proposals to the Corporate Secretary not fewer than 90 and not more than 120 days before the anniversary date of the previous year'syear’s annual meeting.

The bylaws also provide that nominations for director may only be made by the Board of Directors (or an authorized board committee) or by a shareholder entitled to vote who sends notice to Dade Behring not fewer than 90 nor more than 120 days before the anniversary date of the previous year'syear’s annual meeting and complies with the procedures and requirements specified in Dade Behring'sBehring’s bylaws.

To be eligible for consideration at the 2004 Annual Meeting,2006 annual meeting, proposals which have not been submitted by the deadline for inclusion in the proxy statement and nominations for director must be received by the Corporate Secretary between January 27, 200423, 2006 and February 28, 2004.22, 2006. This advance notice period is intended to allow all shareholders to have an opportunity to consider all business and nominees expected to be considered at the meeting.

All submissions to, or requests from, the Corporate Secretary should be made to Dade Behring'sBehring’s principal executive offices at 1717 Deerfield Road, Deerfield, Illinois 60015.60015-0778. A copy of Dade Behring'sBehring’s bylaws is available, without charge, upon written request to the Corporate Secretary.Secretary and on Dade Behring’s Internet site at www.dadebehring.com.

ElectronicHow may I obtain electronic access to proxy materials and annual reports to shareholders?

This proxy statement and Dade Behring's 2002Behring’s 2004 Annual Report to Shareholders are available on Dade Behring'sBehring’s Internet site at http://www.dadebehring.com. Most shareholders can elect to view future proxy statements and annual reports over the Internet instead of receiving paper copies in the mail. If you are a record shareholder, you can choose this option and save Dade Behring the cost of producing and mailing these documents by marking the appropriate box on your proxy card or by following the instructions provided if you vote by telephone. If you are a street name shareholder, please refer to the information provided by the institution that holds your shares and follow that institution'sinstitution’s instructions on how to elect to view future proxy statements and annual reports over the Internet.

3

PROPOSALS

Proposal 1—Election of Directors

Our Board of Directors currently consists of seven members and is divided into three classes, Class 1, Class 2 and Class 3. Each year, the directors in one of the three classes are elected to serve a three-year term. Messrs. JamesRichard W. P. Reid-Anderson, Jeffrey D. BenjaminRoedel and Alan S. CooperSamuel K. Skinner are Class 13 directors and have been nominated and unanimously recommended by the Board of Directors for electionre-election at the Annual Meeting. If elected, theyre-elected, each of them will serve until our 20062008 annual meeting and until their successors havehis successor has been duly elected and qualified or until theirhis earlier resignation or removal. The Class 1 directors will be considered for election at our 2006 annual meeting. The Class 2 directors will be considered for election at our 2004 annual meeting. The Class 3 directors will be considered for election at our 20052007 annual meeting.

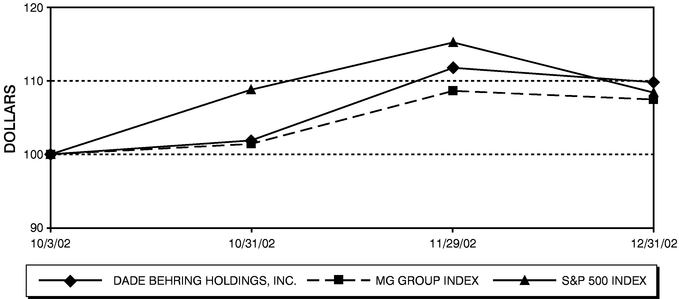

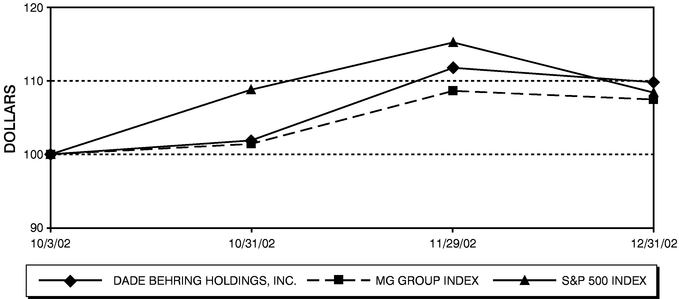

During 2002 Dade Behring completed a financial restructuring on the terms of a plan of reorganization that we refer to as our "Plan of Reorganization." The Plan of Reorganization was implemented pursuant to our bankruptcy filing made under Chapter 11 of the United States Bankruptcy Code. The Bankruptcy Court confirmed the Plan of Reorganization on September 18, 2002 and it became effective on October 3, 2002. All of the current members of the Board of Directors were appointed on effectiveness of the Plan of Reorganization on October 3, 2002, other than Mr. Reid-Anderson, who was first appointed as a director in 2000.

Directors will be electedre-elected by the affirmative vote of a plurality of the votes cast at the Annual Meeting.

Information with respect to Nominees and Continuing Directors

The following table sets forth information as to persons who serve as our directorsdirectors.

Name

| | Age

| | Position

| | Term

Expires

| | Audit

Committee

Member

| | Compensation

Committee

Member

| | Governance

Committee

Member

| | Age | | Position | | Term

Expires | | Audit

Committee

Member | | Compensation

Committee

Member | | Governance

Committee

Member | |

|---|

| James W. P. Reid-Anderson | | 43 | | Chairman, President and CEO | | 2003 | | | | | | | | 46 | | Chairman, President and CEO | | | 2006 | | | | | | | | | | | | | | |

| N. Leigh Anderson Ph.D. | | 53 | | Director | | 2004 | | X | | | | | |

N. Leigh Anderson, Ph.D. | | | 55 | | Director | | | 2007 | | | | X | | | | | | | | | | |

| James G. Andress | | 64 | | Director | | 2004 | | | | X | | X | | 66 | | Director | | | 2007 | | | | | | | | X | | | | X | | |

| Jeffrey D. Benjamin | | 41 | | Director | | 2003 | | | | X | | X | | 43 | | Director | | | 2006 | | | | | | | | X | | | | X | | |

| Alan S. Cooper | | 44 | | Director | | 2003 | | | | X | | X | | 46 | | Director | | | 2006 | | | | | | | | X | | | | X | | |

| Bradley G. Pattelli | | 36 | | Director | | 2005 | | X | | | | | |

| Richard W. Roedel | | 53 | | Director | | 2005 | | X | | | | | | 55 | | Director | | | 2005 | | | | X | | | | | | | | | | |

Samuel K. Skinner | | | 66 | | Director | | | 2005 | | | | X | | | | | | | | | | |

Nominees for ReelectionRe-election at this Annual Meeting (Class 3)

Richard W. Roedel was appointed as a director on October 3, 2002 and is Chairperson of the Audit Committee. Mr. Roedel has been Chairman of Take-Two Interactive Software, Inc. since April 2004 and was Chief Executive Officer from June 2004 to January 2005. Mr. Roedel was Chair of the Audit Committee of that company from November 2002 to April 2004 and has been a director since November 2002. From April 1999 to March 2000, Mr. Roedel was Chairman and Chief Executive Officer of the accounting firm BDO Seidman, LLP. Prior to that, he was the Managing Partner of BDO Seidman’s New York Metropolitan Area Office from 1994 to 1999; the Managing Partner of its Chicago Office from 1990 to 1994; and an Audit Partner from 1985 to 1990. Mr. Roedel received a B.S. degree in accounting and economics from The Ohio State University and is a Certified Public Accountant. Mr. Roedel is a director of publicly held Brightpoint, Inc., a distributor of wireless devices and accessories and a provider of outsourced services in the wireless telecommunications and data industry.

Samuel K. Skinner was appointed as a director on February 18, 2004. Mr. Skinner was President and Chief Executive Officer of US Freightways from July 2000 to May 2003 and in addition was Chairman of the Board of US Freightways from January 1, 2003 through May 2003. From October 1998 to July 2000, Mr. Skinner was a partner and Co-Chairman of the law firm of Hopkins & Sutter. From February 1993 to April 1998, he was President and a director of Commonwealth Edison Company and its parent company, Unicom Corporation. Prior to that time he served as Chief of Staff to the President of the United States. Prior to his White House service, Mr. Skinner served as U.S. Secretary of Transportation for nearly three years. Mr. Skinner is a director of publicly held APAC Customer Services, Inc., a provider of customer

management programs and services; Click Commerce, Inc., a provider of ebusiness software solutions; Diamond Cluster International, a global provider of management consulting services; Express Scripts, Inc., a provider of pharmacy benefit management services; Midwest Air Group, Inc., a licensed commercial air carrier; and Navigant Consulting, Inc., a provider of financial, litigation, healthcare and energy consulting services.

Directors with Terms Expiring in 2006 (Class 1)

James W. P. Reid-Anderson was elected to the Board of Directors in 2000 and was named Chairman of the Board of Directors in October 2002. Mr. Reid-Anderson has served as President and Chief Executive Officer since September 2000. Mr. Reid-Anderson joined us in 1996 as Executive Vice President and Chief Financial Officer for Dade Behring Inc. and became Chief Administrative Officer and Chief Financial Officer in September 1997, responsible for all headquarters functions onafter the mergercombination of Dade and Behring. In April 1999, Mr. Reid-Anderson was promoted to President and Chief Operating Officer. From 1994 to 1996, Mr. Reid-Anderson worked for Wilson Sporting Goods where he served asin a variety of roles including Chief Operating Officer, VP/GM International and Chief Administrative and Chief Financial Officer. In addition, Mr. Reid-Anderson had responsibility for the company'scompany’s international unit. He also held financial positions of increasing responsibility at PepsiCo, Inc., Grand Metropolitan PLC and Mobil Oil Corporation, with roles based in Europe, Asia and North America. Mr. Reid-Anderson is a fellow of the Association of Chartered

4

Certified Accountants and holds a degree with honors from the University of Birmingham in England. Mr. Reid-Anderson also currently serves on the board of directors of Trustmark Insurance Company and the Montessori School of Lake Forest.

Jeffrey D. Benjamin was appointed as a director on October 3, 2002 and is a member of the Compensation and Governance Committees. Mr. Benjamin joinedhas been Senior Adviser to Apollo Management, L.P. as, a Senior Advisor in New York, New York inprivate investment firm, since September 2002. Prior to this,From January 2002 until September 2002, he was employed byManaging Director of Libra Securities LLC, and its predecessors from 1998 to 2002 in various positions, includingan investment banking firm. Previously, he served as Co-Chief Executive Officer. From 1996 through 1998, he was employed by UBS Securities, Inc. as a Managing Director.Officer of U.S. Bancorp Libra, an investment banking firm, from January 1999 until December 2001. Mr. Benjamin also currently serves asis a director of Exco Resources, Inc.,publicly held Chiquita Brands International, Inc., an international producer and distributor of fresh produce; Exco Resources, Inc., engaged in the development and exploitation of oil and natural gas properties in North America; Mandalay Resort Group, a hotel-casino operator; McLeod USA Incorporated, a provider of wired and wireless telecommunications services and communications services; and NTL Incorporated, a cable and McLeod USA.broadband supplier of communications and entertainment services primarily in the United Kingdom and Ireland.

Alan S. Cooper was appointed as a director on October 3, 2002 and is Chairperson of the Governance Committee and a member of the Compensation Committee. On April 1, 2003, Mr. Cooper became a Managing Partner inof Jet Capital Arbitrage and Event Fund I, L.P.,Management, a New York based private investment firm.firm specializing in risk arbitrage, capital structure arbitrage and other event-driven investing. Prior to such time, Mr. Cooper had been a Principal of Redwood Capital Management hedge fund located in Englewood Cliffs, New Jersey from 2000 to March 2003. Prior to joining Redwood Capital, he served as General Counsel to Dickstein Partners, Inc. from 1992 to 2000 and also as Vice President beginning in 1994.

Directors with Terms Expiring in 20042007 (Class 2)

N. Leigh Anderson, Ph.D. was appointed as a director on October 3, 2002 and is a member of the Audit Committee. Dr. Anderson is Founder and Chief Executive Officer of the Plasma Proteome Institute, or PPI, in Washington, D.C. Dr. Anderson also consults through Anderson Forschung Group, where he is a Principal. Prior to founding PPI, he was Chief Scientific Officer at Large Scale Biology Corporation, or LSBC, whose proteomics division he founded in 1985 and led as Chief Executive Officer prior to its merger in 1999 with Biosource Technologies, which created the current LSBC. He founded, along with Dr. Norman Anderson, the Molecular Anatomy Program at the Argonne National Laboratory in Chicago

where his work in the development of 2-D electrophoresis and molecular database technology earned him, among other distinctions, the American Association for Clinical Chemistry'sChemistry’s Young Investigator Award for 1982 and the 1983 Pittsburgh Analytical Chemistry Award.

James G. Andress was appointed as a director on October 3, 2002 and is Chairperson of the Compensation Committee and a member of the Governance Committee. From 1996 through 2000, Mr. Andress served as President and Chief Executive Officer of Warner Chilcott, PLC. Warner Chilcott is a pharmaceutical company that develops prescription drugs in the areas of women'swomen’s health care, urology, dermatology and cardiology. He was appointed Chairman of Warner Chilcott, PLC in 1998. Mr. Andress also currently serves asis a director of thepublicly held The Allstate Corporation, Information Resources,; Sepracor Inc., Option Care, Inc., Sepracor, Inc.a research based pharmaceutical company; and Xoma Corporation.Corporation, a biopharmaceutical development company.

Directors with Terms Expiring in 2005 (Class 3)

Bradley G. Pattelli was appointed as a director on October 3, 2002 and is a member of the Audit Committee. Mr. Pattelli is a Director at Angelo, Gordon & Company in New York, New York, an investment firm specializing in non-traditional asset management. Mr. Pattelli has been employed at Angelo, Gordon & Company from 1998 to the present where he is the Director, Distressed Debt, Leveraged Loan and Special Situations. From 1997 through 1998, he was employed at DiSilvestri Asset Management as Analyst/Co-Portfolio Manager, Long-Short Equity Fund.

Richard W. Roedel was appointed as a director on October 3, 2002 and is Chairperson of the Audit Committee. Mr. Roedel is the Co-Founder and Principal of Pinnacle Ventures LLC in New Canaan, Connecticut, which was started in 2000. From 1985 through 2000, he was employed by BDO Seidman, LLC as an Audit Partner, later being promoted in 1990 to Managing Partner in Chicago and then

5

Managing Partner in New York in 1994 and finally in 1999 to Chairman and Chief Executive Officer. Mr. Roedel currently serves as director of Take-Two Interactive Software, Inc. and Brightpoint, Inc.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTEFOR THE

ELECTIONRE-ELECTION OF MESSRS. JAMESRICHARD W. P. REID-ANDERSON, JEFFREY D. BENJAMINROEDEL AND

ALAN S. COOPERSAMUEL K. SKINNER AS CLASS 13 DIRECTORS

Proposal 2—Amendment to Dade Behring's ThirdBehring’s Fourth Amended and Restated

Certificate of Incorporation to Increase the Number of

Authorized Shares of Common Stock and Preferred Stock

The Board of Directors has authorized, and recommends for your approval, an amendment to Dade Behring's ThirdBehring’s Fourth Amended and Restated Certificate of Incorporation, increasing the number of authorized shares of common stock from 5065 million to 65150 million shares, par value $.01 per share. In addition, the proposed amendment would proportionately increase the number of shares of preferred stock of Dade Behring from 50,00065,000 shares to 65,000150,000 shares, par value $.01 per share. A copy of the proposed Certificate of Amendment is attached to this proxy statement as Appendix A.

On AprilMarch 1, 2003,2005, of the 50,050,00065,065,000 authorized shares of the Company, a total of 40,039,06744,025,162 shares of common stock were outstanding and 8,293,1247,717,569 shares of common stock were reserved for potential issuance in connection with our stock incentive plans. No shares of preferred stock are currently outstanding and all of the authorized shares of preferred stock are reserved for issuance as Series A Junior Participating Preferred Stock for the purposes of Dade Behring'sBehring’s rights agreement. A total of 13,322,269 shares of common stock are authorized, unissued and not reserved for issuance.

Although there are sufficient shares available to permit all presently contemplated issuances, the Board believes that the proposed amendment is in the best interests of the Company and its shareholders.shareholders because the Company currently has a limited number of authorized and unissued shares that are not reserved for issuance. The proposed amendmentincrease in Dade Behring’s authorized share capital will provide Dade Behring with flexibility of action in the future by assuring there will be sufficient authorized but unissued shares of common stock available for issuance in connection with a primary offering of common stock, a stock split, acquisitions of the stock or assets of another company, employee benefit plans and other general corporate purposes without the necessity of further shareholder action at any special or annual meeting. The Board will determine whether, when and on what terms the issuance of shares of common stock may be warranted in connection with any of the foregoing purposes. Dade Behring has no immediate plans, arrangements, commitments or understandings with respect to the issuance of any of the additional shares of common stock that would be authorized by the proposed amendment. In addition, the proposed increase in the number of authorized shares of preferred stock will be necessary to accommodate Dade Behring'sBehring’s obligation to issue additional preferred stock purchase rights, and reserve additional shares of Series A Junior Participating Preferred Stock, pursuant to its rights agreement as a result of the increase in the number of authorized shares of common stock.

An increase in the authorized shares of common stock could, under certain circumstances, have an anti-takeover effect. For example, if the Board issues additional shares in the future, such issuance could dilute the voting power of a person seeking control of the Company, thereby deterring or rendering more difficult a merger, a tender offer, proxy contest or an extraordinary transaction opposed by the Board of Directors. This proposal to increase the number of authorized shares is prompted by business and financial reasons and is not in response to any effort of which the Company is aware to accumulate the Company’s common stock or obtain control of the Company. Nevertheless, shareholders should be aware that approval of the proposal could facilitate future efforts by the Company to deter or prevent changes in control of the Company, including transactions in which shareholders might otherwise receive a premium for their shares over current market prices. All of the additional shares of preferred stock to be authorized will be reserved for issuance as Series A Junior Participating Preferred Stock for the purposes of Dade Behring’s rights agreement which the Governance Committee and the Board of Directors reviews from time to time.

If the proposed amendment is approved, the additional shares of common stock will be available for issuance from time to time without further action by shareholders (unless required by applicable law, regulatory agencies or by the rules of any stock market on which Dade Behring'sBehring’s shares of common stock may then be listed) and without first offering more shares to shareholders. Shareholders do not have pre-emptive rights with respect to the common stock or preferred stock. The issuanceshares of common stock or preferred stock or securities convertible into common stock or preferred stock, on other than a pro rata basis would result in the dilution of a present shareholder's percentage interest in Dade Behring.to be authorized.

Dade Behring has not proposed the increase in the authorized number of shares of common stock with the intention of using the additional shares for anti-takeover purposes, although the Company could theoretically use the additional shares to make it more difficult or to discourage an attempt to acquire control of Dade Behring. As of this date, Dade Behring is unaware of any pending or threatened efforts to acquire control of the Company.

The proposed amendment provides that Section 1 of Article Four of the Company's ThirdCompany’s Fourth Amended and Restated Certificate of Incorporation be amended in its entirety to read as follows:

(1) The total number of shares of all classes of stock which the corporation shall have authority to issue is 65,065,000,150,150,000, consisting of (1) 65,000,000150,000,000 shares of Common Stock, par value $.01 per share,

6

and (2) 65,000150,000 shares of Preferred Stock, par value $.01 per share. The number of authorized shares of any of the Preferred Stock or the Common Stock may be increased or decreased (but not below the number of shares thereof then outstanding) by the affirmative vote of the holders of a majority in voting power of the stock of the corporation entitled to vote thereon irrespective of the provisions of Section 242(b)(2) of the General Corporation Law of the State of Delaware (or any successor provision thereto), and no vote of the holders of any of the Preferred Stock or the Common Stock voting separately as a class shall be required therefor.

Approval of the proposed amendment requires the affirmative vote of a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting. Neither an abstention nor a broker non-vote is an affirmative vote. Therefore, both abstentions and broker non-votes will have the effect of votes cast against the proposed amendment. If the proposed amendment is approved by shareholders, it will become effective upon the filing of a Certificate of Amendment with the Secretary of State of the State of Delaware, which Dade Behring plans to file as soon as practicable following the Annual Meeting. The Board of Directors has unanimously approved the proposed amendment and believes it to be in the best interests of the Company and the shareholders.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTEFOR THE

PROPOSAL TO AMEND DADE BEHRING'S THIRDBEHRING’S FOURTH AMENDED AND RESTATED CERTIFICATE

OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES

OF COMMON STOCK AND PREFERRED STOCK

Proposal 3—Approval of the Dade Behring Nonemployee Directors' Deferred Stock Compensation Plan

We are asking shareholders to approve the Dade Behring Nonemployee Directors' Deferred Stock Compensation Plan (the "Directors' Plan"). The purpose of the Directors' Plan is to advance the interests of the Company and its stockholders by providing a means to attract and retain qualified persons to serve as directors. It is intended (1) to permit directors to defer receipt—and therefore taxability—of all or a portion of their compensation as directors and (2) to encourage a greater ownership interest by directors in the Company. Our Board of Directors adopted the Directors' Plan on February 4, 2003. A copy of the Directors' Plan is attached to this proxy statement as Appendix B. The description herein is a summary and not intended to be a complete description of the Directors' Plan. Please read the Directors' Plan for more detailed information.

Available Shares

The maximum number of shares of common stock that can be distributed under the Directors' Plan is 100,000, subject to adjustment in the event of certain corporate or share events such as recapitalizations or stock splits. The shares of common stock under the Directors' Plan may include authorized but unissued shares, treasury shares, or shares reacquired by the Company.

Administration

The Directors' Plan will be administered by the entire Board or, if the Board decides, by a committee designated by the Board. The Board or committee, as applicable, has the authority to make determinations it deems appropriate for administering the Directors' Plan, subject to the express terms of the Directors' Plan.

Eligibility

Any director who is not an employee of the Company or of any subsidiary or affiliate may participate in the Directors' Plan. Six current directors are eligible to participate in the Directors' Plan.

7

Election to Defer Compensation

Nonemployee directors are entitled to fees for their services as directors. (See Director Compensation, page ). Eligible directors may elect to defer all or a percentage (not less than 50% and in increments of 5% up to 100%) of their fees. Directors may make a deferral election prior to the effective date of the Directors' Plan or before the first day of any subsequent calendar year for which deferral is elected, in accordance with administrative procedures established for the Directors' Plan. A new nonemployee director may make the election, in accordance with administrative procedures established for the Directors' Plan, before the first day he or she is entitled to receive fees.

The deferral election applies to all fees payable after the election is made, until the election is revoked or modified. Any revocation or modification will only be effective for director fees payable in a subsequent calendar year and must be made before the first day of any subsequent calendar year in accordance with administrative procedures established with respect to the Directors' Plan.

Operation of Stock Unit Accounts

Director fees for which deferral elections have been made will be deferred when they would otherwise have been paid. Fees deferred will be credited on a bookkeeping basis to the directors' stock unit account. The fees will be converted to stock units based on the fair market value of our common stock on each date of deferral. (For purposes of the Directors' Plan, fair market value is generally determined as the mean between the highest and lowest reported sale price of a share of common stock on such date.) Each stock unit will give the director the right to receive one share of common stock when the stock unit account is distributed.

In the event dividends are declared and become payable with respect to our common stock, on each dividend payment date, dividends which would have been paid on a number of shares of common stock equal to the number of stock units credited to the directors' stock unit account as of the dividend record date will be converted to stock units based on the fair market value of common stock on such dividend payment date and added to the directors' stock unit account.

If the director make no other election, distribution of the stock unit account will begin after the director's service as a director or employee terminates for any reason. If the director so elects, the stock unit account may be distributed as soon as administratively feasible after a date the director specifies or upon a change in control (as defined in the Directors' Plan). Distribution may be either in a lump sum or in substantially equal installments over a period of not more than five years, as elected by the director.

If a director dies before the entire stock unit account has been distributed, the balance in the stock unit account will be paid in shares of common stock to the beneficiary designated by the director, if any, or otherwise to the survivor spouse, if any, or to the director's estate.

Amendment or Termination of the Directors' Plan

The Directors' Plan may be amended or terminated by the Board at any time provided that no action taken without the consent of an affected director may materially impair the rights of such director with respect to any stock units already credited to the director's stock unit account. However, the Directors' Plan specifically permits the termination and payout of stock unit accounts upon a change in control (as defined in the Directors' Plan). The Directors' Plan will terminate by its own terms when no shares of common stock remain available under the Directors' Plan and the Company has no further rights or obligations under the Directors' Plan.

8

New Plan Benefits

The following table summarizes the benefits or the amounts that will be received or allocated to each of the following groups pursuant to the Dade Behring Nonemployee Directors' Deferred Stock Compensation Plan for the period April 1, 2003 through June 30, 2003—the period for which these benefits or amounts are determinable.

| | Dade Behring Nonemployee

Director Deferred Stock

Compensation Plan

| |

|---|

Name and Position

| | Dollar Value ($)

| | Number of Units

| |

|---|

| James W. P. Reid-Anderson, President and Chief Executive Officer | | | N/A | | N/A | |

| Dominick M. Quinn, Executive Vice President | | | N/A | | N/A | |

| Hiroshi Uchida, Executive Vice President | | | N/A | | N/A | |

| John M. Duffey, Senior Vice President and Chief Financial Officer | | | N/A | | N/A | |

| Mark Wolsey-Paige, Executive Vice President | | | N/A | | N/A | |

| Executive Group | | | N/A | | N/A | |

| Non-Executive Director Group | | $ | 39,375 | (1) | 2,123 | (1),(2) |

| | | | | |

| |

| Non-Executive Officer Employee Group | | | N/A | | N/A | |

(1)Based on current elections for 2003 by eligible directors with respect to their retainer fees for the period April 1, 2003 through June 30, 2003. This dollar amount was converted into units by dividing the dollar amount by the stock price when such dollar amounts otherwise would have been paid. Such units, including adjustments such as for any stock splits or dividends, will be paid in shares of common stock after the end of the directors' service or such other designated time. Amounts allocable for the second half of calendar year 2003 and thereafter depend upon a number of variables as set forth in footnote (2).

(2)The number of shares of common stock to be issued and units to be credited under the plan for the second half of calendar year 2003 and thereafter will depend on future variables such as stock prices, the number of nonemployee directors, the level of participation of nonemployee directors and any increases in compensation of directors from time to time and is thus not currently determinable.

The affirmative vote of the holders of a majority of the shares represented in person or by proxy at the Annual Meeting and entitled to vote on the resolution is required for approval of the Directors' Plan. The Board of Directors has unanimously approved the Directors' Plan and believes it to be in the best interests of the Company and the shareholders. All non-employee directors are eligible to participate in the Directors' Plan and therefore have a personal interest in its approval.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR THE

DADE BEHRING NONEMPLOYEE DIRECTORS' DEFERRED STOCK COMPENSATION PLAN

Proposal 4—Approval of the Dade Behring Employee Stock Purchase Plan

We are asking shareholders to approve the Dade Behring Employee Stock Purchase Plan (the "Employee Stock Purchase Plan"). The Employee Stock Purchase Plan allows employees to purchase Dade Behring common stock at a discount using payroll deductions. Shareholder approval of the Employee Stock Purchase Plan would entitle employees in the United States to receive special tax treatment provided by the Internal Revenue Code (the "Code").

Our Board of Directors adopted the Employee Stock Purchase Plan on November 7, 2002, subject to shareholder approval. The Employee Stock Purchase Plan provides for the issuance of up to one million shares of common stock. A copy of the Employee Stock Purchase Plan is attached to this proxy

9

statement as Appendix C. The description herein is a summary and not intended to be a complete description of the Employee Stock Purchase Plan. Please read the Employee Stock Purchase Plan for more detailed information.

Description of the Employee Stock Purchase Plan

The purpose of the Employee Stock Purchase Plan is to provide employees of the Company and those subsidiaries designated to participate in the Employee Stock Purchase Plan with an opportunity to purchase shares of common stock. The Employee Stock Purchase Plan has two portions—one portion for employees in the United States and one portion for international employees.

The portion of the Employee Stock Purchase Plan for employees in the United States is intended to qualify as an "employee stock purchase plan" under Section 423 of the Code. The provisions of such portion of the Employee Stock Purchase Plan, accordingly, will be construed so as to extend and limit participation in a manner consistent with the requirements of that section of the Code.

A total of one million shares of common stock will be available for issuance and purchase under the Employee Stock Purchase Plan. The number of shares of common stock available for issuance and purchase under the portion of the Employee Stock Purchase Plan for United States employees will be one million shares of common stock less the number of shares of common stock used for the employee stock purchase programs for employees outside the United States. If any purchase right terminates for any reason without having been exercised, the shares of common stock not purchased under such purchase right shall again become available for the Employee Stock Purchase Plan.

The Employee Stock Purchase Plan will be administered by the administrative committee for our benefit plans or any other committee appointed by the Board to administer the Employee Stock Purchase Plan (the "Committee"). The Committee has the full and exclusive discretionary authority to construe and interpret the Employee Stock Purchase Plan and the rights granted under it, to designate from time to time which subsidiaries of the Company will participate in the Employee Stock Purchase Plan, to establish rules and regulations for the administration of the Employee Stock Purchase Plan and to amend the Employee Stock Purchase Plan to satisfy applicable laws, to obtain any exemption under such laws or to reduce or eliminate any unfavorable legal, accounting or consequences. The Committee also may adopt special rules for employees of the Company's international subsidiaries to conform to the particular laws and practices of the countries in which such employees reside.

Eligibility

Generally, all United States employees of the Company and its designated subsidiaries whose customary employment is for more than 20 hours per week and who have completed at least one year of service with the Company or any subsidiary are eligible to participate in the Employee Stock Purchase Plan. Employees of designated subsidiaries outside the United States may have different eligibility requirements as determined appropriate by the Committee, for example, to accommodate local requirements and practices. However, any employee who would own or have options to acquire five percent (5%) or more of the total combined voting power or value of all classes of stock of the Company or any subsidiary is excluded from participating in the Employee Stock Purchase Plan. As of December 31, 2002, there were approximately 4,500 employees eligible to participate in the Employee Stock Purchase Plan.

Purchase of Shares of Common Stock

Pursuant to procedures established by the Committee, eligible employees may elect to have a portion of their compensation used to purchase shares of common stock. Purchase periods are established (currently contemplated to be successive six-month periods) and purchases of shares of common stock are made on the last trading day of the purchase period with compensation amounts

10

withheld from employees during the purchase period. Pursuant to procedures established by the Committee, employees may suspend the amount of compensation being withheld during a purchase period or may withdraw prior to the end of the purchase period any amounts previously withheld during the purchase period, without interest. If during a purchase period an employee suspends the withholding of compensation or withdraws amounts previously withheld, such employee may not recommence withholding of compensation for the purchase of shares of common stock until the following purchase period.

On each purchase date (the last trading day of each purchase period), any amounts withheld from an employee's compensation during the applicable purchase period for purposes of the Employee Stock Purchase Plan will be used to purchase the greatest number of whole shares of common stock that can be purchased with such amounts. The purchase price for a share of common stock will be set, unless the Committee determines higher percentages, at the lesser of (i) eighty-five percent (85%) of the fair market value of a share of common stock on the first trading day of the purchase period or (ii) eighty-five percent (85%) of the fair market value of a share of common stock on the purchase date. For purposes of the Employee Stock Purchase Plan, "fair market value" generally means the closing sales price of a share of common stock for the day. As of April 4, 2003 the closing sales price of a share of common stock was $18.85 per share.

The Code limits the aggregate fair market value of the shares of common stock (determined as of the beginning of the purchase period) that any employee in the United States may purchase under the Employee Stock Purchase Plan during any calendar year to $25,000. The Committee may impose restrictions or limitations on the resale of shares of common stock purchased under the Employee Stock Purchase Plan. Employees in the United States must notify the Company if shares of common stock are disposed of in a disposition that does not satisfy the holding period requirements of Section 423 of the Code (generally, as discussed below, two years from the beginning of the applicable purchase period).

The Company will pay the administrative costs associated with the operation of the Employee Stock Purchase Plan. The employees will pay any brokerage commissions that result from their sales of shares of common stock.

The Company may deduct or withhold or require employees to pay to the Company any federal, state, local and other taxes the Company is required to withhold with respect to any event arising as a result of the Employee Stock Purchase Plan. The Company may also deduct those amounts from the employees' wages or compensation.

Effect of Certain Corporate Events

The Employee Stock Purchase Plan provides for adjustment of the number of shares of common stock which may be granted under the Employee Stock Purchase Plan as well as the purchase price per share of common stock and the number of shares of common stock covered by each purchase right for any increase or decrease in the number of shares of common stock resulting from a stock split, reverse stock split, stock dividend, extraordinary cash dividend, combination or reclassification of the common stock or recapitalization, reorganization, consolidation, split-up, spin-off or any other increase or decrease in the number of shares of common stock effected without receipt of consideration by the Company.

In the event of any corporate transaction, the Committee may make such adjustment it deems appropriate to prevent dilution or enlargement of rights in the Employee Stock Purchase Plan, in the number, class of or price of shares of common stock available for purchase under the Employee Stock Purchase Plan and in the number of shares of common stock which an employee is entitled to purchase and any other adjustments it deems appropriate. In the event of any transaction, the Committee may elect to have the purchase rights under the Employee Stock Purchase Plan assumed or such purchase

11

rights substituted by a successor entity, to set an earlier purchase date, prior to the consummation of such corporate transaction, to terminate all outstanding purchase rights either prior to their expiration or upon completion of the purchase of shares of common stock on the next purchase date, or to take such other action deemed appropriate by the Committee.

Amendment or Termination

The Board may amend the Employee Stock Purchase Plan at any time, provided such amendment does not cause rights issued under the portion of the Employee Stock Purchase Plan for United States employees to fail to meet the requirements of Section 423 of the Code or cause rights issued under the Employee Stock Purchase Plan to fail to meet the requirements of any securities exchange on which shares of common stock are traded. Moreover, any amendment for which shareholder approval is required under Section 423 of the Code or such securities exchange must be submitted to the shareholders for approval. The Board may terminate the Employee Stock Purchase Plan any time.

U.S. Federal Income Tax Consequences

The following discussion is only a brief summary of the United States federal income tax consequences to the Company and employees under the portion of the Employee Stock Purchase Plan applicable to employees in the United States. It is based on the Code as in effect as of the date of this Proxy Statement. The discussion relates only to United States federal income tax treatment; state, local, foreign, estate, gift and other tax consequences are not discussed. The summary is not intended to be a complete analysis or discussion of all potential tax consequences.

The amounts deducted from an employee's pay pursuant to the Employee Stock Purchase Plan will be included in the employee's compensation and be subject to federal income and employment tax. Generally, no additional income will be recognized by the employee either at the beginning of the purchase period when purchase rights are granted pursuant to the Employee Stock Purchase Plan or at the time the employee purchases shares of common stock pursuant to the Employee Stock Purchase Plan.

If the shares of common stock are disposed of at least two years after the first day of the purchase period to which the shares of common stock relate and at least one year after the shares of common stock were acquired under the Employee Stock Purchase Plan (the "Holding Period"), or if the employee dies while holding the shares of common stock, the employee (or in the case of the employee's death, the employee's estate) will recognize ordinary income in the year of disposition or death in an amount equal to the lesser of (a) the excess of the fair market value of the shares of common stock on the first trading day of the purchase period over the purchase price of the share of common stock or (b) the excess of fair market value of the shares of common stock at the time of such disposition over the purchase price of the shares of common stock.

If the shares of common stock are sold or disposed of (including by way of most gifts) before the expiration of the Holding Period, the employee will recognize ordinary income in the year of sale or disposition in an amount equal to the excess of the sales price over the purchase price. Even if the shares of common stock are sold for less than their fair market value on the purchase date, the same amount of ordinary income is included in income.

In addition, the employee generally will recognize capital gain or loss in an amount equal to the difference between the amount realized upon the sale of shares of common stock and the employee's tax basis in the shares of common stock (generally, the amount the employee paid for the shares of common stock plus the amount, if any, taxed as ordinary income). Capital gain or loss recognized on a disposition of shares of common stock will be long-term capital gain or loss if the employee's holding period for the shares of common stock exceeds one year. The purchase date begins the holding period for determining whether the gain or loss realized is short or long term.

12

If the employee disposes of shares of common stock purchased pursuant to the Employee Stock Purchase Plan after the Holding Period, the Company will not be entitled to any federal income tax deduction with respect to the shares of common stock issued under the Employee Stock Purchase Plan. If the employee disposes of such shares of common stock prior to the expiration of the Holding Period, the Company generally will be entitled to a federal income tax deduction in an amount equal to the amount of ordinary income recognized by the employee as a result of such disposition.

New Plan Benefits

Participation in the Employee Stock Purchase Plan is entirely within the discretion of the eligible employees. Because the Company cannot presently determine the participation levels by employees, the rate of contributions by employees and the eventual purchase price under the Employee Stock Purchase Plan, it is not possible to determine the value of benefits which may be obtained by executive officers and other employees under the Employee Stock Purchase Plan. Nonemployee directors are not eligible to participate in the Employee Stock Purchase Plan.

The affirmative vote of the holders of a majority of the shares represented in person or by proxy at the Annual Meeting and entitled to vote on the resolution is required for approval of the Employee Stock Purchase Plan. The Board of Directors has unanimously approved the Employee Stock Purchase Plan and believes it to be in the best interests of the Company and the shareholders.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTEFOR THE

DADE BEHRING EMPLOYEE STOCK PURCHASE PLAN.

CORPORATE GOVERNANCE AND RELATED MATTERS

BOARD OF DIRECTORS' MEETINGS, COMMITTEES AND FEES

Our Board of Directors held ten meetings during

Dade Behring is managed under the year ended December 31, 2002. During 2002, eachdirection of our current directors attended 75% or morea seven member Board of the meetings of the Board held during the period for which he has been a director and attended 75% or more of the meetings of committees of the Board on which he served held during the period for which he served. Among the standing committees ofDirectors. In fulfilling its duties, the Board of Directors areand its committees oversee the corporate governance of Dade Behring, oversee and advise management in developing our financial and business goals, evaluate management’s performance in pursuing and achieving those goals, and oversee our public disclosures and the disclosure processes. During fiscal 2004, the Board held six meetings. Mr. Roedel did not attend one of the Board meetings. Mr. Skinner did not attend two Board meetings and one of the Audit Committee meetings. Each of the other directors attended 100% of all Board and applicable Committee meetings.

Our policy on director attendance at annual meetings calls for directors to be invited but not required to attend Dade Behring’s annual meetings of shareholders. Messrs. Anderson, Andress, Benjamin, Cooper, Roedel and Reid-Anderson attended the 2004 Annual Meeting of Shareholders.

Executive sessions of non-management directors are generally held incident to regular Board meetings. The non-management directors have not designated a lead director; instead, executive sessions are led by the committee chairs or other director proposing the agenda item. Any non-management director can propose agenda items or request that an additional executive session be scheduled.

Independence

The Board of Directors has determined that each of the six non-management directors, including all members of the Audit, Compensation and Governance Committees are “independent” as defined by applicable listing standards of The Nasdaq Stock Market currently in effect and approved by the Securities and Exchange Commission (the “SEC”), and all applicable rules and regulations of the SEC, and that each is an “outside director” for purposes of Rule 162(m) of the Internal Revenue Code of 1986, as amended.

Financial Expertise

The Board of Directors has determined that two members of the Audit Committee, Richard W. Roedel and Samuel K. Skinner, possess the attributes to be considered financially sophisticated for purposes of Applicable Nasdaq Marketplace Rules and that Richard W. Roedel has the background to be considered an “audit committee financial expert” as defined by the rules and regulations of the SEC.

Board Committees

Our Board has the following three standing committees: Audit Committee, Compensation Committee and the Governance Committee, which in addition toalso serves as the nominating committee. Each committee operates under a written charter adopted by the Board. The membership during the last fiscal year, the function of each of the committees and where you can find a copy of its other functions, acts as a nominating committee.charter are described below.

Audit Committee

The Audit Committee assists the Board in fulfilling its responsibilities for general oversight of the integrity of our financial statements, compliance with legal and regulatory requirements, the independent registered public accounting firm’s qualifications and independence, the performance of our internal audit function and the work of our independent registered public accounting firm, and risk assessment and risk management. Among other things, the Audit Committee: prepares the Audit Committee report for inclusion in this proxy statement; annually reviews the Audit Committee charter and the committee’s performance; appoints, evaluates and determines the compensation of the independent registered public accounting firm; reviews the scope of the annual audit, the audit fee and the financial statements; pre-approves all audit and permissible non-audit services to be provided by our independent registered public

accounting firm; reviews Dade Behring’s disclosure controls and procedures, including internal control over financial reporting, information security policies, the internal audit function, and corporate policies with respect to financial information; establishes procedures for the receipt, retention and treatment of complaints to Dade Behring regarding accounting, internal accounting controls or auditing matters and for the confidential, anonymous submission by our employees of accounting or auditing concerns; oversees investigations into complaints concerning financial matters; approves any related party transactions; and reviews other risks that may have a significant impact on the Company’s financial statements. The Audit Committee works closely with management as well as our independent registered public accounting firm. The Audit Committee has the authority to obtain advice and assistance from, and receives appropriate funding from Dade Behring for, outside legal, accounting or other advisors as the Audit Committee deems necessary to carry out its duties.

The members of the Audit Committee are Richard W. Roedel (Chairperson), N. Leigh Anderson, Ph.D. and Bradley G. Pattelli. All membersSamuel K. Skinner. The report of the Audit Committee meet the independence requirements of the National Association of Securities Dealers rules. The Audit Committee, among other things provides assistance to the Board of Directors in its oversight of:

•the integrity of the Company's financial statements and the related public reports, disclosures and regulatory filings in which they appear;

•the systems of internal control over financial reporting, operations, and legal/regulatory compliance;

•the performance, qualifications and independence of the Company's independent auditors;

•the performance, qualifications and independence of the Company's internal audit function; and

•compliance with the Company's ethics policies and applicable legal and regulatory requirements.

The Board of Directors has adopted a written charter for the Audit Committee. The Audit Committee reviews and reassesses the adequacy of this charter at least annually. A copy of the written charter is attached as Appendix D to this proxy statement.begins on page 11. The Audit Committee held sixseven meetings including two telephonic meeting during 2004. The charter of the Audit Committee is available under the Corporate Governance heading on the Investors Relations Section of our website at www.dadebehring.com.

13

during 2002. See "Audit Committee Information—Report of Audit Committee" on page for more information.

Compensation Committee

Principal responsibilities of the Compensation Committee, as outlined in its charter, are to review and approve overall compensation programs including base salary, short-term and long-term incentive awards for the Company’s senior management and Chief Executive Officer, to approve all senior management and the Chief Executive Officer employment contracts, to review and evaluate the performance of the Chief Executive Officer, and to review management’s succession planning and management development recommendations. The charter of the Compensation Committee is available under the Corporate Governance heading on the Investors Relations Section of our website at www.dadebehring.com.

The Compensation Committee consists exclusively of non-employee members of the Board of Directors. The members of the Compensation Committee are James G. Andress (Chairperson), Jeffrey D. Benjamin and Alan S. Cooper. The Compensation Committee among other things: (i) reviews and approves all compensation programs forheld eight meetings including three telephonic meetings during 2004. The Report on Executive Compensation by the chief executive officer and senior managementCompensation Committee begins on page 15.

Governance Committee

The Governance Committee: identifies individuals qualified to become Board members, consistent with criteria approved by the Board; oversees the organization of the Company,Board to discharge the Board’s duties and responsibilities properly and efficiently; and identifies best practices and recommends corporate governance principles, including base salarygiving proper attention and short-termmaking effective responses to shareholder concerns regarding corporate governance. Other specific duties and long-term incentiveresponsibilities of the Governance Committee include: annually assessing the size, composition and compensation plans, including stock options; (ii) prepares reportsof the Board; developing Board membership qualifications; defining specific criteria for director independence; monitoring compliance with Board and Board committee membership criteria; annually reviewing and recommending directors for continued service; coordinating and assisting management and the annual proxy statement; (iii) reviewsBoard in recruiting new members to the Board; annually, and approves annual changes intogether with the chief executive officer's and each senior executive officer's compensation, including base salary and short-term and long-term incentive awards, and approves all senior management employment contracts; (iv) annually reviewsChairman of the Compensation Committee, evaluating the performance of the chief executive officerChairman of the Board and (v) reviews management's succession planningCEO and management development recommendations. The Compensationpresenting the results of the review to the Board and to the Chairman and CEO; reviewing and recommending proposed changes to Dade Behring’s charter and bylaws and Board committee charters; laws and Board committee charters; assessing periodically and recommending action with respect to shareholder rights plans or other shareholder protections; recommending Board committee assignments; reviewing and approving any employee director standing for election for outside for-profit boards of directors; reviewing

governance-related shareholder proposals and recommending Board responses; overseeing the evaluation of the Board and management; conducting a preliminary review of director independence and the financial literacy and expertise of Audit Committee held seven meetings during 2002. See "Executive Compensation and Other Information" on page .members.

Governance Committee

The members of the Governance Committee are Alan S. Cooper (Chairperson), James G. Andress and Jeffrey D. Benjamin. Among other functions,The Governance Committee held five meetings during 2004. The Corporate Governance Manual is available under the Corporate Governance heading on the Investors Relations Section of our website at www.dadebehring.com.

Consideration of Director Nominees

Shareholder Nominees

The policy of the Governance Committee: (i) studies and makes recommendations concerningCommittee is to consider properly submitted shareholder nominations for candidates for membership on the size and composition of the Board of Directors and its committee structure; (ii) recommends persons to be nominated by the Board of Directors for election as directors of the Company; (iii) considers nominees recommended by shareholders for election as directors of the Company; and (v) has general responsibility for the Company's corporate governance activities.Board. Recommendations by shareholders for director nominees should be forwarded to the Corporate Secretary and should identify the nominee by name and provide detailed information concerning his or her qualifications. The Company'sCompany’s bylaws require that shareholders give advance notice and furnish certain information to the Company in order to nominate a person for election as a director. See the discussion under "Shareholder Proposals"the question “How may a shareholder make a proposal or nominate a candidate for election as a director” on page . 3 of this proxy statement.

Director Qualifications

The Dade Behring Corporate Governance Manual contains Board membership criteria that apply to Governance Committee-recommended nominees for a position on our Board. Under these criteria, members of the Board should have the highest professional and personal ethics and values, consistent with longstanding Dade Behring values and operating principles. They should have demonstrated management ability at high levels in successful organizations. They should have expertise germane to Dade Behring’s operations in a global setting and to provide insight and practical wisdom based on experience. They should have sufficient time to carry out their obligations as a director and limit their service on other boards to a number that permits them, given their individual circumstances, to perform responsibly all director duties. They should be committed to enhancing shareholder value. Each director must represent the interests of all shareholders.

Identifying and Evaluating Nominees for Directors

The Governance Committee held fourutilizes a variety of methods for identifying and evaluating nominees for director. The Governance Committee regularly assesses the appropriate size of the Board, and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that vacancies are anticipated, or otherwise arise, the Governance Committee considers various potential candidates for director. Candidates may come to the attention of the Governance Committee through current Board members, professional search firms, shareholders or other persons. These candidates are evaluated at regular or special meetings of the Governance Committee, and may be considered at any point during 2002.the year.

Director CompensationCommunications with Directors

In order to provide security holders and other interested parties with a direct and open line of communication, the Board has adopted the following procedures for communications to directors.

Shareholders and other interested persons may communicate with the Chairs or other members of our Audit, Compensation or Governance Committees by using the following e-mail addresses: Audit

Committee (auditchair@dadebehring.com) Compensation Committee (compchair@dadebehring.com) and Governance Committee (govchair@dadebehring.com).

DIRECTOR COMPENSATION

Directors who are not employees of the Company each received an annual cash retainer of $40,000$50,000 during 2002.2004 and will receive an annual cash retainer of $55,000 during 2005. Mr. Roedel received aan additional $15,000 annual retainer in 2004 for his services as Audit Committee Chair. Beginning in 2005, the Audit Committee Chair will receive an additional $20,000 annual retainer and each Audit committee member will receive an additional $5,000 annual retainer. Mr. Andress and Mr. Cooper each received aan additional $5,000 annual retainer during 2004 for their respective services as Compensation Committee Chair and Governance Committee Chair.

The retainers are paid in quarterly installments in advance. In addition,Eligible directors are reimbursedmay defer receipt of director’s fees otherwise payable to them and invest those fees in common stock units provided for meeting expenses.

On October 24, 2002, the Board of Directors approvedunder the Dade Behring 2002 DirectorNonemployee Directors’ Deferred Stock Option PlanCompensation Plan. Directors were reimbursed for nonemployee directors. Under the plan, eachexpenses incurred as a result of attendance at Board or Committee meetings.

Each nonemployee director serving in 2002 received an inaugurala grant of options in 2002 to purchase 25,000 shares of common stock. The exercise price for such stock options is $14.72. Approximately one-third of eachsuch option grant will vestvested on October 3, 2003, approximately an additional one-third will vestvested on October 3, 2004 and each option grant will become fully vested on October 3, 2005. Upon becoming a director in February, 2004, Mr. Skinner was granted an option to purchase 25,000 shares of common stock under the Dade Behring 2004 Incentive Compensation Plan, subject to approval of that plan by shareholders which occurred at the 2004 annual meeting. Approximately one-third of such option grant vested as of February 18, 2004, approximately an additional one-third vested on October 3, 2004 and the grant will become fully vested on October 3, 2005.

14We are considering providing each person upon first being appointed or elected a director, after January 1, 2005, options equal to a value (based on Black Scholes or binomial model) of $250,000 on the date of grant. Such options will vest in equal installments on the first, second and third anniversary of the grant date and have an exercise price equal to the fair market value of the Company’s shares on the grant date. We are also considering providing that each director, upon completion of three full years of service, will become eligible on the October 1st following completion of three years of service and each October 1st thereafter, for a restricted stock unit award equal to the value of $65,000 per year. The number of restricted stock units awarded will be determined quarterly by dividing $16,250 by the fair market value of the Company’s shares on the first day of each quarter. The restricted stock units will vest on the first, second and third anniversary of the date the director becomes eligible for the award. The director stock options and restricted stock units will be granted and administered under the Dade Behring 2004 Incentive Compensation Plan.

AUDIT COMMITTEE INFORMATION